In our archives, somewhere, are buried the remains of a large essay we were planning on writing about John Law once upon a time. My, how a decade flies when you are having fun!

Antoine Murphy (a wonderfully Beckett sounding name) is your man for all things Law-ful. In his book on Law, he grasps the very central point of what Law called the systéme. Law had seen that the national economies of his day were held back by specie money. Specie money, like gold or silver coin, is, as it were, a self-valueing asset. Its weight and metallic content are, ideally, equal to the value on its face. Thus, the man who carries a gold coin carries a coin literally worth its weight in gold. When a kingdom needed to debase its money, it did so by stinting on the weight and composition of its coinage. Swift’s wrath against the brummagen coinage issued by William Wood, under license from the crown, and with the blessing of the assayer of the mint, Isaac Newton, was directed at the drain of real value that would occur when gold coins at a false weight were exchanged for true. Asset money was always a constraint on a kingdom since it depended on there being in circulation enough gold and silver to allow for the consistent issuance of money. Law correctly saw that this system would forever restrain commerce. Thus, as Murphy explains, Law introduced credit money. The worth of credit money depends on its position in the whole financial system. It is worth nothing in itself except the promise it carries on its face. With credit money, as Murphy points out, an “array of new monetary products (liabilities) ... can be created [from the credit-money system] and the range of loan products (assets) that can be produced.” (108)

When the regent took power after the death of Louis XIV, he was staring at a kingdom that had long been bankrupted to pay for Louis’ wars and projects. Law, a gambler and an outlaw from England (where he’d escaped imprisonment for murder at Newgate), had long been proposing a credit-money scheme to various kingdoms, including Scotland. The Regent, desperate for any expedient to lift the monarchy from ruin, agreed at last to Law’s schemes. I won’t bother with the details of the stages by which Law moved from running a bank to running a monopoly on trade – the Compagnie de l’orient, popularly known as the Mississippi company – to finally running a bank combined with a trade and tax monopoly (the collection of taxes were farmed out in France) with royal backing. And indeed, pumping credit money into France got the country going again. Instead of edging up against the artificial constraint of too little specie money, a stream of credit money re-inflated France’s commerce and reinvigorated the agricultural sector. Law calculated that France could stand a total of 3 billion livres in coinage – a calculation he based on its potential for trade, and its comparative size against England, which was estimated to have 1 billion livres in circulation.

Finally, Law tied credit money to an asset – land. Land had the advantage of not being portable, for one thing – unlike gold. And for another thing, land was, Law thought, the basis of wealth. Having been ceded the land of the Mississippi, Law’s company divided it up – in a sense. That is, one could buy shares of it. And those shares could be exchanged for his bank’s billet, which were supported by the tax farms, which paid off the King’s debt, which had been paid by a loan from the bank.

There are two obvious problems: one is, how do we control the issuing of credit money? it seems like there is a built in incentive to create, as Montesquieu claimed, imaginary money – or at least it was easier to debauch credit money. And the second problem was asset money. People could refuse to exchange credit money and demand asset money. And this would automatically make credit money of less value.

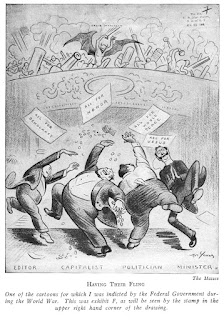

In 1719 and 1720, the Mississippi company “boomed” – meaning that credit money circulated and shares in the Mississippi company rose spectacularly in value. The company’s brokerage house on Quincampoix street became a famous scene of a sort of continual avarice riot. All classes thronged it, trading, going broke, becoming rich. But it was a very fragile structure, a bubble, and at the first sign of trouble, when the shares went down, there was a flight to asset money that devalued the credit money. Law attributed this to the plague that struck Marseilles in 1720 – the same plague Artaud wrote about in Theater and its Double. Artaud wrote about the social structure liquifying in the face of the plague, which was true in one sense. But that liquification was an old fashioned chaos. What was really liquifying the social structure was credit money, and here, the plague created a very conservative reaction. Doctors wanted asset money. So did the butcher, the baker, and the candlestickmaker. Which is when Law persuaded the Regent (who, along with his friends, had become extremely wealthy via Law’s system) to issue a decree banning, in effect, specie money. This was the beginning of the end – the use of force shook confidence in Law, and his enemies used this decree to spread rumors about the true purpose of the system.

Law was forced from his position as France’s Controller General – the position that Colbert held – and had to flee France in a carriage loaned to him by Mme de Prie, a woman who valued her favors. This one was meant to get rid of Law with the least possible difficulty. Mme de Prie had made a mint in the bubble, and in time became Louis XV’s mistress, where she used her influence to keep Law from being recalled to France.

I wonder if, as the carriage crossed the French border, where Law was stripped of his passport and pocket change, whether one could hear, on the wind, the words: “mes gages, mes gages, mes gages.” Or was it something altogether more grandiloquent that ushers in the culture of happiness?

Chi l'anima mi lacera?

Chi m'agita le viscere?

Che strazio, ohimè, che smania!

Che inferno, che terror!

“I’m so bored. I hate my life.” - Britney Spears

Das Langweilige ist interessant geworden, weil das Interessante angefangen hat langweilig zu werden. – Thomas Mann

"Never for money/always for love" - The Talking Heads

Subscribe to:

Post Comments (Atom)

Pasts that could have been - the Marxist who helped found the Republican party

The Trajectory of the Republican party is a sad thing. It is now Trump's plaything. But did you know - kids out there - that one of th...

-

You can skip this boring part ... LI has not been able to keep up with Chabert in her multi-entry assault on Derrida. As in a proper duel, t...

-

The most dangerous man the world has ever known was not Attila the Hun or Mao Zedong. He was not Adolf Hitler. In fact, the most dangerous m...

-

Being the sort of guy who plunges, headfirst, into the latest fashion, LI pondered two options, this week. We could start an exploratory com...

1 comment:

AO 128 = COOL BLUE MIST OF VAPORIZED BANK NOTES = A TOTALITY CONTAINED WITH A TOTALITY = DRAGULA (HOT ROD HERMAN REMIX) - ROB ZOMBIE = "ELEONORA" (FONSECA PIMENTEL, ELEONORA) (1) = IMPURE IMPURE HISTORY OF GHOSTS = LASTLY, I WANT A TRIP IN THE SPACE SHUTTLE = NARRATIONS OF THE LIMIT-EXPERIENCE = PRIVILEGED PLACE FOR INNOVATION = SEATED UPON THE THRONE OF THE MOTHER = SOCIETY OF SEMINARY TEACHERS OF QOM = SPEED OF LIGHTNING, ROAR OF THUNDER = TAU OMICRON CHI ALPHA OMICRON STIGMA = TEMPERAMENT IS IMPRINTED ON THE FACE = THE EDIFICE OF POLITICAL THEORY = THE MAGIC OF RISKING EVERYTHING ( AO-232 THE MAGIC OF RISKING EVERYTHING FOR A DREAM THAT NOBODY SEES BUT YOU) = THE PRACTICE OF ENOCHIAN EVOCATION = WIT HAS NO INTERNAL OR INTIMATE CHARACTER.

Post a Comment