“I’m so bored. I hate my life.” - Britney Spears

Das Langweilige ist interessant geworden, weil das Interessante angefangen hat langweilig zu werden. – Thomas Mann

"Never for money/always for love" - The Talking Heads

Friday, September 23, 2011

A little history of the Income Tax

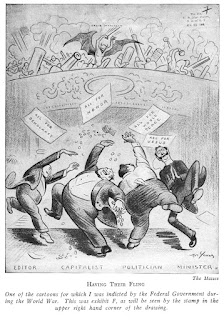

Naturally, LI finds the class warfare cry that has gone up with Obama’s proposal to tax the wealthy at a less onerous rate than they were taxed in the 90s rather comic, as class warfare is precisely what is at the heart of progressive taxation. Progressive taxation can best be seen as one of those complex treaties, like that which officially divided up Yugoslavia, that takes a situation of ongoing hostility and freezes it in place. It allows the wealthy to continue to exploit and flourish, but at a cost.

However, there is one aspect of the right’s class warfare meme that seems to have taken root with a considerable number of middle class citizens, which is that there is something unfair about the wealthy paying 50 percent of the total of the income tax collected by the government. The usual response to this by liberals is to point out that federal taxes also consist of taxes for social security and medicare, so that the figure for income tax alone is distorting. This is true.

However, it also concedes the point, and this is bogus. A little historical research will tell us why.

In W. Elliot Brownlee’s dry as a cracker history of the Income Tax (Federal Taxation in America: a history) there is an account of the roots of the Income Tax and the intentions of its designers that makes it clear that the designers meant the income tax to be paid completely, lock stock and barrel, by the rich.

Back in 1916, as Wilson plotted to get America into WWI, the financing of that war was high on the agenda. Southern Democrats, who back then combined racism and populism, saw this as a good opportunity to create a truly progressive tax system.

In Brownlee’s words:

“The Democratic tax program, which was implemented in the

wartime Revenue Acts, transformed the experimental, rather tentative

income tax into the foremost instrument of federal taxation.

The Revenue Act of 1916 imposed the first significant tax on personal

incomes, doubled (to 2 percent) the tax on corporate incomes,

and introduced an excess profits tax of 12.5 percent on munitions

makers. It rejected a broadly based personal income tax—

one falling most heavily on wages and salaries—and focused on

the taxation of the wealthiest families. Among the provisions of the

1916 legislation was the elimination of the personal exemption for

dividends. Thus, the act deliberately introduced the double taxation

of corporate earnings distributed as dividends. In effect, the

1916 legislation embraced the concept of using the corporate and

personal income taxes as two different means of taxing the rich.

The architects of the Revenue Act of 1916 intended to implement

on one hand, through the personal income tax, an “ability-to-pay”

philosophy and on the other hand, through corporate taxation, a

“benefit” theory of taxation.”

What was the result of this?

“In 1918, only about 15 percent of American families had to

pay personal income taxes, and the tax payments of the wealthiest

1 percent of American families accounted for about 80 percent

of the revenues from the personal income tax. Even without taking

into account the incidence of the corporate income tax on the rich,

this wealthiest 1 percent of taxpayers paid marginal tax rates ranging

from 15 to 77 percent and effective rates averaging 15 percent,

having increased from 3 percent in 1916.”

Say it loud and say it proud: Only the rich should pay income tax! That was the intent, that was the early history, and that was how even the Republican administrations of the 1920s saw things. But the Republican administrations were, after all, business friendly, and one of the things they did was to erase as much as they could indirect taxes – tariffs and corporate taxes – and thereby accidentally increased the importance of the income tax as a funding vehicle for government:

“Mellon’s tax program consolidated the flow of income-tax revenues

into the Treasury. The portion of general revenues provided

to the federal government by indirect taxes (largely the tariff) fell

from almost 75 percent in 1902 to about 25 percent in the 1920s;

meanwhile, income-tax revenues increased, accounting for nearly

50 percent of the federal government’s general revenues. As had

been the case in World War I, income-tax revenues proved to be

more abundant than the Treasury experts had forecast, and the

Republican administrations enjoyed substantial, growing budget

surpluses until the onset of the Great Depression.”

Those income tax revenues, mind, came from the wealthiest income group. In a country where the median income was some 2 thousand dollars per year, the first 3,000 dollars of income was not taxed. As Mellon, the conservative Treasury Secretary put it:

“Mellon went so faras to advocate providing a greater reduction in taxes on “earned”

than on “unearned” income, and the Revenue Act of 1924 included

such a provision. “The fairness of taxing more lightly incomes from

wages, salaries, or from investments is beyond question,” Mellon

asserted. “In the first case, the income is uncertain and limited in

duration; sickness or death destroys it and old age diminishes it;

in the other, the source of income continues; the income may be

disposed of during a man’s life and it descends to his heirs.”

While this was a plea for greater death taxes, it was also a concession to the Edgeworthian logic of the tax, in which the determining factor is the marginal utility of income. As the marginal utility of a dollar to a man making 50,000 dollars is much greater than it is for a man making 1 million dollars, the logical thing is to tax the man making 1 million dollars. It does less harm.

So far, so good. But the worm in this apple lies in the notion of ‘investments”. Income, after all, must provide for current expenses and savings in a household. Up until the seventies, the savings of a middle class household were presumed to be in some private pension in combination with social security. Then, of course, the neo-liberal ideology began putting its sharp little teeth in the hide of the developed economies. Why not use tax deductions to get the mass of that savings flowing into the markets? Oh, what a win win proposition. In fact, the winners were naturally in the financial sector – they were the very malefactors of great wealth Roosevelt talked about 70 years before. And so the assets of middle income households were gradually tied to the private financial services sector - stocks and bonds – as their taxes went up to provide for government services and their incomes stagnated. The latter fact was not separate from their investments in the market – in effect, middle class households began betting on their own lack of income growth. This was all very well as long as there were bubbles to make those stock investments grow. Bubbles aren’t bad or good things – they are just the way that technology, population growth and capital converge. However, they let you down in a pinch. Thus, the empire of pensions built up by white collar workers since the Depression, and union workers too, was dissipated in the fine frenzy of the financial markets, and after the first wave, the 401(k) ripoff replaced the traditional pension.

It is this which has introduced an interesting variant into our class war. Their assets of households have made them the allies of the wealthy (this was the intended political dimension of neo-liberal policies) even though the wealthy are really not their allies at all, as any business cycle will show you.

If there were a progressive community in America, this story would be on their radar and they would be fighting against it. One way is to divorce Main Street and Wall Street. This is why LI is a big fan of the government providing a means of investing money with a guaranteed safe rate of return outside of the stock market. Theresa Ghilarducci made a suggestion in 2008 that we stop giving a tax credit to 401(k)s and introduce Guaranteed Retirement Accounts, in which the average person can simply open a government account and park money in it, earning non-taxed interest, with the aim of creating a retirement fund worth 70 percent of a person’s pre-retirement income.

This would be the single biggest blow against the neo-lib agenda since the seventies. A truly liberal president would have Ghilarducci as his advisor. One day we will have such a president, although I imagine Ghilarducci will be retired at that point. At present, we have a president named Obama who is a bit to the right of Andrew Mellon on economic issues. A pity, that.

Subscribe to:

Post Comments (Atom)

Pasts that could have been - the Marxist who helped found the Republican party

The Trajectory of the Republican party is a sad thing. It is now Trump's plaything. But did you know - kids out there - that one of th...

-

You can skip this boring part ... LI has not been able to keep up with Chabert in her multi-entry assault on Derrida. As in a proper duel, t...

-

The most dangerous man the world has ever known was not Attila the Hun or Mao Zedong. He was not Adolf Hitler. In fact, the most dangerous m...

-

Being the sort of guy who plunges, headfirst, into the latest fashion, LI pondered two options, this week. We could start an exploratory com...

No comments:

Post a Comment